The analysis of a case can be addressed under several perspectives, the financial, the operational, the strategic, etc. The topic we are covering today, the Harvard case “Sothebys.com“, will be adressed with focus on the basic principles of Supply Chain and Marketing, nevertheless nothing is absolute and less in the enterprise world, so a multidisciplinary approach will not be forgotten.

The analysis of a case can be addressed under several perspectives, the financial, the operational, the strategic, etc. The topic we are covering today, the Harvard case “Sothebys.com“, will be adressed with focus on the basic principles of Supply Chain and Marketing, nevertheless nothing is absolute and less in the enterprise world, so a multidisciplinary approach will not be forgotten.

The case and the facts related are dated on 1998 and 1999, we will consider that period of time along the write up although it is written in the middle of 2009, when it is really difficult remove from our minds the omnipresence and growing relevance of websites and business networks on the global economy.

”Sothebys.com” The strategic movement of a leader or just a fashions trend follower?

The relevance of Sothebys in the art, antiquities and luxury goods is unquestionable. Why this “traditional” house embraces the internet revolution just in the “dot com” hurricane crisis? The clue most probably rely on a careful look to the financial performance of the company, their operations nature and, undoubtedly, their competitors movements and market situation. Along this write up we like to analyze the financial situation of the company, where the revenues come from, where is the market growing. This implies to make the market segmentation of the antiquities and luxury goods auctions, the target market of the company and the way Sothebys is building the brand positioning. We would like to know why people is attending a Sothebys auction, what are the insights for purchasing and what are the intricate operations behind the transactions performed, the actors involved and their roles. Considering these factors all together we can conclude jumping into the internet arena was not only a good decision of the company but the “right” one if any.

Financial performance of Sothebys

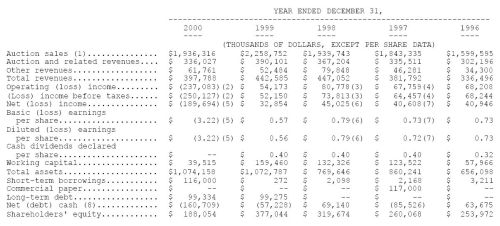

Not always the strategy of a company is driven by financial targets but most frequently a change on the strategy is triggered by financial figures, perhaps this was the case of Sothebys. Looking the case financial data (Exhibit 1) we see that besides an increase on revenue of 16% from 1998 to 1999, the net income decrease 27%, but looking for additional data on the Sothebys annual report we confirm a dangerous trend, a new big long term debt, stagnation on sales and confirmed afterwards (not available on public data by early 2000, the case date, but most probably foresee by the top management) get into company losses.

Form 10-K, Annual report for the fiscal year ended 31 December, 2001.

The case also outlined on several places the low profit of most of the operations, the high cost of the catalog, etc. We will see later that operations were very complex and therefore expensive and we will see also the competitor pressure were strong, inside the business (Christies) and outsiders also (eBay). Something has to be done to improve figures. A careful review to the present market, to the nature of the operations and the changes on the competitive environment drives us to the convenience to open “online” auction services, this seems to be the worldwide trend, the virtualization of markets and seems to be the key to process optimization and address each customer segment in the more efficient way.

Market segmentation

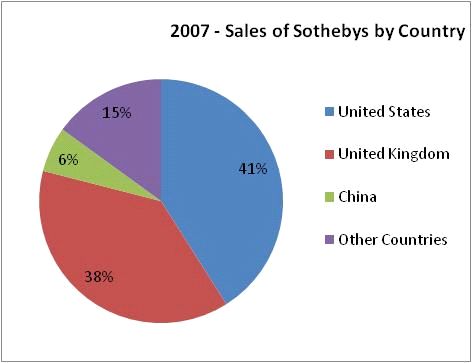

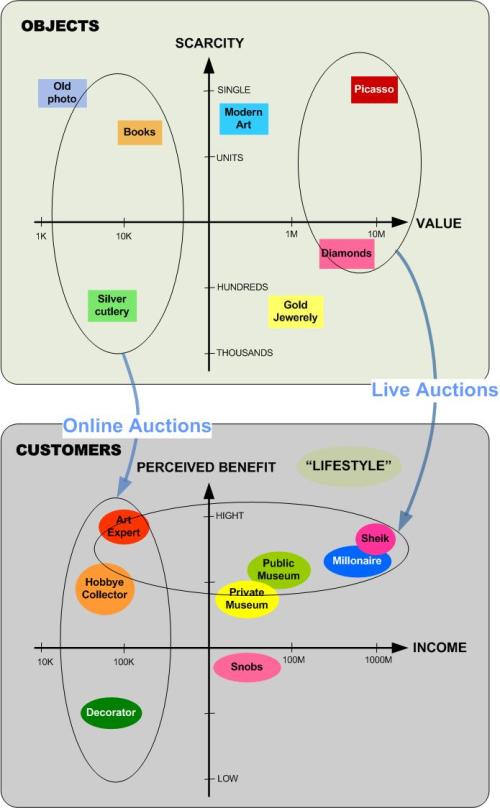

Looking for the operational excellence and financial profitability, The presence of the company in the market has to be supported by the right brand positioning, this is way a clear market segmentation is required. The first segmentation variable it comes to our mind when thinking about the reasons a person buy an object in a Sothebys auction is the psychographic one, where lifestyles and peer-group identity play a major role. Considering this variable we found customers like collectors (of art or any other cultural thing), early adopters of contemporary art, snobs, etc. Each of this people has a reason to participate and buy in an auction. Other variable to consider is a demographic one, the family income and educational and cultural background seems to dominate this variable. Within that we can consider university professors or art experts, for instance. The geographic variable also operates, don’t forget the Sothebys auction rooms are located in New York and London, contributing to a bigger business coming from USA and UK customers. This is a segment market the online auctions “Sothebys.com” is broadening but not eliminating because each regional area has their own cultural identity.

Out of the date where the case is written but the left picture shows how most of the customers are coming from three countries. The product/object use/application also take part, consider for instance the purchase for a public museum or for a private collection, different purchasing behavior and budgets. Two key point have to be consider, one is that all these variables act together, not isolated, for instance, we can segment by “rich Chinese snob” or “medium class north American collector”, etc. The second point is how dynamic the segmentation has to be, the considered variables are evolving, specially on the present internet times, where sothebys.com is playing. This will led to a huge universe of market segments, each one with their own product/market opportunities. The usual way of plot this variables into a “positioning map” that simplify the aggregation of customers to be addressed in a similar way. The same clustering could be done with the object for auctioning giving us a graphical tool for segmentation handling.

A single pair of two dimension maps are not enough to describe completely the richness of objects and relevant customer segments but we can build several maps concentrating on the variables we consider pertinent using the positioning maps like a graphical data-mining tool. The key issue the map isolate is the strong difference of the ratio “number of items or transactions / hammer price” for certain type of goods or customers. There are a big potential of sales but with the present operations procedure they were out of the profit area. The idea behind sothebys.com is to address this new markets in a profitable way without compromise the brand positioning. Traditional brand means exclusivity, differentiation, glamour … but the internet could open the door to the opposite brand values. How to solve the paradox of exclusivity and mass market? Matching customer segments with product segments and follow an hybrid approach.

Competitors

Competition is strongly related with the market segment Shothebys is addressing, but at a first glance we can indicate some active players on this arena; the traditional “high end” art and antiquities auction houses like Christies (London), Finarte-Semenzato (Milano – Italy) and Philips, de Pury (New York) and other substitutes to the live auctions that are playing successfully in the online world like eBay and other internet retailers like Amazon.

It is out of the scope of this work to perform a deeply study of competitors, but their presence indicates this is an attractive business and if we do not attend in the right way our customers (the segments we are already operating) or the potential customers (the new segments) the competition could find a way to do that. This implies no action is a dangerous action.

The main competitor in the live auction business is traditionally Christies, comparable on size, target market and reputation. Christies could easily open an online site, as in fact he did, and we can’t be a player out of this channel. The other competitors are far from Sothebys market share to be consider a thread in the short term, we are speaking about eBay.

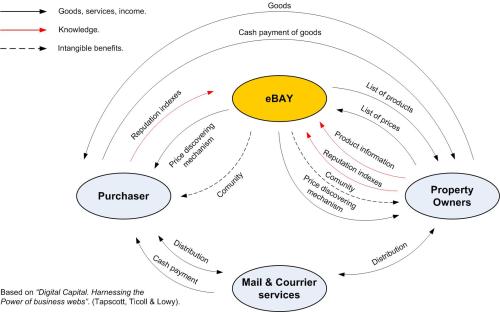

Regarding the “classic” auction site eBay, their scope is so broad and their customer base so heterogeneous that there are a clear room for a player in the art and antiquities specialized sector, this is the place for sothebys.com. Because we are going to enter the online auctions, it is a good practice to know what the main player is doing well in the business to imitate and where is down performing to avoid it. The activity map of eBay is depicted above where the involved agents and the products, information and knowledge flows are sketched.

There is some novel concepts that most probably explain the great succeed of eBay, besides the inherent to an auction “mechanism of price discovering”, the establishment of a “reputation index” brings the auction online a mechanism to establish trust among participants. This is something not implemented at sothebys.com but trust rely on the brand. That’s why it is so important the selection of the people who is going to attend customers at call centers (customer service agents), the specialist to solve inquiries and the selection of the “Associates”, they are key brand builders. Other relevant element introduced by eBay is the creation of a community. Sothebys.com address this topic creating the “Associates Network” which contributes also to reinforce trust and overcome the feeling among dealers that sothebys.com were cannibalizing their own business.

When to succeed on that market is required to increase the number of transactions, we have to know that this growing implies and exponential increase of the difficulties to manage the operations. Here is when we realize the advantage to rely on the expertise of the leader in that market and this is a key movement of Sothebys top management, establish an alliance with amazon.com, the worldwide leader of online trading, this movement convert a potential competitor on a reliable partner.

A new approach to operations

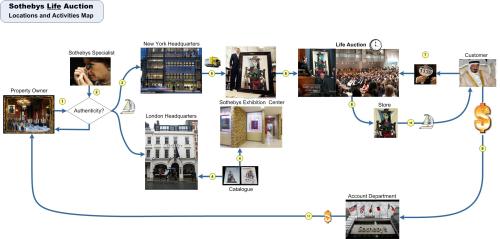

The case perform a detailed description of the agents, activities, goods and information flows involved into the “Live Auctions”. We are not going to repeat them here, but to depict graphically the operations process to make easier highlight the differences when comparing with the “Online Auction” process.

There are some characteristic unique of the live action process; all the goods to be sold are consigned to Sothebys and shipped to the headquarters in London or New York, carefully and detailed catalogued, public displayed and handled physically to the auction room. All this task are very time consuming and very expensive. Other characteristic is the auction itself, it is a real time process that takes few minutes, if not seconds per item or lot. This bring us the concept of “buy-in” rate, around 30% which gives us a reference of the efficiency of the auction. The whole process is time consuming and expensive but is the one that provides the seller and buyer the feeling to be exclusive, to participate in a unique process, plenty of glamour and reliable, a process handle by a company we can rely on. This is where brand power comes into their own. Undoubtedly this is the way to market the kind of products with high value and few units addressed to the type of customer described during the market segmentation process. No question about that.

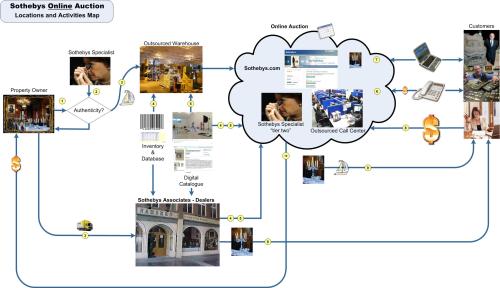

What about the thousands of objects that saturates the Shothebys machine? Remembering the case this is an activity mandatory at present, “to sell off the silver in order to get the Modigliani”, and the introduction of the “Online auctions” is perhaps the touchstone to handle that mess. Let’s take a look to the operations flow of “Virtual Auctions”:

The first look suggest we added complexity, this is right regarding the information flows and the number of agents included (mainly the Associates) but not if we consider the daily operations once the whole mechanism is stabilized. Two main paths exists, following the case nomenclature, the “Physical Lots” and the “Dealer Lots”. Virtualization enables to make a big cost reduction on the most expensive task, produce and distribute the catalogues, and the often physical manipulation/transportation of the goods.

The more radical change was the integration of the Associates, this open to the possibility to handle the big amount of “minor” articles, gives also the possibility to customize the attention to a broader range of customers (geographically and psychographically) and increase considerably one strategic and scarce resource for Sothebys, the specialist. Without the help of the Associates the specialists would be overloaded.

CRM at dot com

The “moment of truth”, when there is an interaction with the customer is exploding, becomes outsourced and the glamour around Sothebys is under risk, so all the effort to outperform has to be applied. A 24 hours call center was set up, the education and skills of the assigned agents is carefully selected, all the communications channels open (web, chat, forums, e-mail, telephone), a user friendly interface, with a careful web page design, not only the aesthetics and appearance, rather the interaction process and flow through pages and contents “navigation had to reflect the overarching purpose of the whole enterprise”, also the web page has to reflect the way people´s mind work, organically and associatively, not hierarchically (like programmers tend to do). Under this virtual and aggregated environment the volume and type of questions are predictable which allows to plan in advance capacity and pertinent solutions and answer to most frequent issues. The target is to provide a good customer feeling of the service and don’t lose at any “moment of contact” the glamour and excellence we expected from Sothebys.

Leverages

If we follow the novelties introduced by the new operations architecture we found some of them reinforced the other and act like leverages. For instance, the auction is not real time, the average duration is a couple of weeks, this not real time auction enable to run simultaneously as many auctions we want and this continuous auctioning process means we can incorporate the buy-in lots into a new auction immediately.

A usual trick on services marketing is to get the customer perform some work, the “Dealer Path” got this trick not with the customer but with the Associate, he has to make the digital catalogue, promote the auction and collect the objects from the vendor and ship them to the purchaser.

The agent is also an specialist, an scarce resource, and participate in a network of Associates to avoid competition from them and avoid they felt Sothebys is cannibalizing their mown market.

Conclusion

Remember Sotheby’s main function is to serve as the intermediary between buyers and sellers of art, and this is what the tree channels does. But what makes possible the most profitable part of the business is the brand reputation of art expertise to proper value and the glamour around. Based on the right segmentation and the use of different market channels Sothebys solve the paradox of exclusivity and simultaneously mass trading while keeping the traditional positioning of Sothebys brand. Don’t forget every people has a different understanding of uniqueness and glamour and this is why there were arranged the three operating channels.

We are writing the case well after the publication date and we know what happens. We now present financial figures and they show the good performance of the company. Somehow the introduction of the “Virtual Auctions” process contributes. Figures like 50% buy-in rates by reoffered immediately and 50% buy-in rate again support this believe.

Zara, Inditex group, is a phenomenon on the garment retail industry and a reference for many Worldwide medium size companies that looks on Zara the way to a global succeed without leaving the business where they are, regardless how competitive it is and without leaving headquarter location regardless how away are form the hot hubs.

Zara, Inditex group, is a phenomenon on the garment retail industry and a reference for many Worldwide medium size companies that looks on Zara the way to a global succeed without leaving the business where they are, regardless how competitive it is and without leaving headquarter location regardless how away are form the hot hubs.

Recent Comments